Enhancing Access to International Arbitration: The Role of Third-Party Funding and Conditional Fee Agreements

Enhancing Access to International Arbitration: The Role of Third-Party Funding and Conditional Fee Agreements

Third-party funding and conditional fee agreements are important tools that allow parties with meritorious claims—but limited resources—to pursue their claims with the support of a third party. Particularly, in international arbitration proceedings, parties face the financial pressures of having to pay for legal fees, adverse costs orders, and the arbitration tribunal’s and institution’s fees. To ensure that arbitration remains a reliable and accessible option for dispute resolution, Singapore has permitted the use of third-party funding and conditional fee agreements to ease some of these pressures.

Before entering into such arrangements, it is important to understand their structure and the practical implications they carry. In this article, we outline how third-party funding and conditional fee agreements operate, and highlight key considerations to bear in mind when deciding whether to adopt these mechanisms.

Third-Party Funding

Third-party funding refers to an arrangement where a commercial funder agrees to cover part or all of a claimant’s legal costs and related expenses. The Civil Law Act 1909 and the Civil Law (Third-Party Funding) Regulations 2017 allow for contracts providing for a qualifying third-party funder[1] to fund a party’s costs in prescribed classes of dispute resolution proceedings. These classes are:

- international arbitration proceedings;

- court proceedings or mediation proceedings arising out of or in any way connected with international arbitration;

- applications for a stay of proceedings under section 6 of the International Arbitration Act 1994 (“IAA”) and any other application to enforce an arbitration agreement; and

proceedings for or in connection with the enforcement of an award or foreign award under the IAA.

The classes above are not exhaustive. In the recent case of DNQ v DNR [2025] SGHC 152 (“DNQ”), the Court affirmed that third-party funding arrangements may also be utilised for other types of proceedings so long as (1) the third-party funding is incidental to a transfer of property, or the third-party funder has a legitimate interest in the outcome of the matter; and (2) there is no realistic possibility that the administration of justice may suffer as a result of the third-party funding arrangement.

Third-party funding is frequently deployed in “portfolio” arrangements, where a funder finances a group of related claims brought by a particular client or law firm. A recent illustration is the Credit Suisse bond default matter, in which Omni Bridgeway supported a proposed investor-state group action by holders of CS AT1 Bonds seeking compensation from the Swiss Confederation for losses arising from the March 2023 Credit Suisse–UBS merger.

On balance:

a. Third-party funding helps to level the playing field against better-resourced opponents. It also enables a party to conserve its working capital, rather than tying it up in legal disputes. A party would also be able to obtain an independent view of their case through the funder’s due diligence.

b. However, such arrangements can significantly reduce net recovery from the case. For example, in DNQ, the funder stood to receive US$24m (i.e., the original US$6m of funding plus the US$18m of the funder’s profit) or approximately 56% of the proceeds. Parties may also need to be prepared to cede control over their litigation or arbitration strategy to third-party funders.

Parties considering a third-party funding arrangement should pay close attention to defining what is a successful outcome. Additionally, the parties should also determine what will happen in an unsuccessful outcome (e.g. who will be liable for adverse costs orders). Parties who are looking to enter into a third-party funding agreement should also keep abreast and comply with any arbitration rules which may apply. For example, Rule 38 of the Singapore International Arbitration Centre Rules 2025 requires a party to disclose the existence of any third-party funding agreement and details pertaining to the third-party funder.

In conclusion, although third-party funding can ease the financial pressures of pursuing or defending a claim, it also brings with it various commercial and strategic considerations. Parties should scrutinise the funding terms, be clear about how the arrangement may influence decision-making in the proceedings, articulate what constitutes a successful or unsuccessful outcome, and remain mindful of any procedural obligations such as disclosure. When thoughtfully negotiated and implemented, third-party funding can serve as a useful mechanism to manage costs while enabling viable claims to move forward.

Conditional Fee Agreements

A conditional fee agreement refers to an agreement relating to all or part of the remuneration and costs in contentious proceedings, whether conducted in Singapore or elsewhere, under which a lawyer’s fees are payable only in specified circumstances. A conditional fee agreement may also include an uplift fee,[2] which is an additional amount payable upon achieving a successful outcome.

Under Section 115A (1) Legal Profession Act 1966 and Regulation 3 of the Legal Profession (Conditional Fee Agreement) Regulations 2022, conditional fee agreements may be used only in prescribed proceedings, including:

a. International and domestic arbitration;

b. Certain proceedings before the Singapore International Commercial Court ; and

c. court or mediation proceedings related to the above.

Two common arrangements for conditional fee agreements are:

a. “No Win, No Fee” – No legal fees or uplift fees are payable unless the agreed success conditions are met.

b. “No Win, Less Fee” – A discounted fee is payable if the case is unsuccessful.

Parties entering into conditional fee agreements should be aware of both their advantages and limitations:

a. Such agreements offer considerable flexibility, allowing clients and lawyers to blend traditional billing with conditional fee components within the same matter. They also provide greater cost certainty for cash-constrained clients, who can anticipate their legal fees in the event of an unsuccessful outcome.

b. On the other hand, a successful outcome will generally result in higher legal fees and the conditional fee will not be considered or included when the court or tribunal issues the legal costs order, meaning that the successful party will have to bear the conditional fee even if they win the case. In addition, as with third-party funding—parties must take care to define clearly what constitutes success for the purposes of the agreement. Conditional fee agreements should expressly provide for cost consequences if terminated before completion. Cost consequences should also be addressed for scenarios involving a change of solicitor, whether arising from the client’s decision, or due to the lawyer’s incapacity or death.

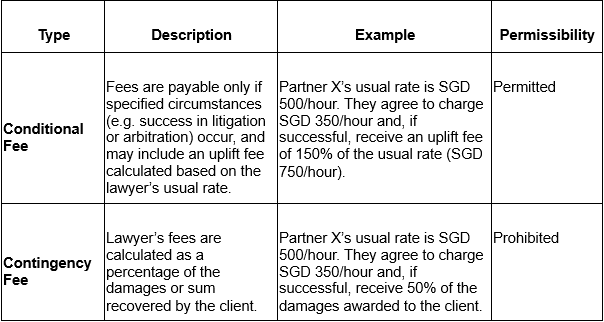

We pause at this juncture to note the distinction between conditional fee agreements (which are allowed), and contingent fee agreements (which are not allowed). Their differences can be shown as follows:

Before entering into a conditional fee agreement, lawyers must inform the client that they have the right to seek independent legal advice, that the agreement does not affect third-party costs recovery (meaning opposing parties are not liable for any uplift fees), and that the client remains responsible for any adverse costs orders issued by the court or tribunal.

Every conditional fee agreement must also contain certain mandatory terms, including a clear description of what triggers the conditional fee, the basis for calculating it and its estimated amount, a 5-day cooling-off period for termination, a requirement that any variation be in writing with a new 3-day cooling-off period, and a provision that clients are only liable for work specifically instructed during the cooling-off period.

Concluding thoughts

Third-party funding and conditional fee agreements are welcome additions to the suite of tools available to parties in arbitration. As the legal framework governing these mechanisms is still developing, it remains to be seen how the courts and tribunals will ultimately interpret and apply the relevant rules. In the meantime, both lawyers and clients should exercise care to ensure that the terms of any third-party funding or conditional fee arrangements are clearly defined and appropriately documented.

If you have any questions, please do not hesitate to contact us:

Irvin Ho (irvin.ho@helmsmanlaw.com)

Zhang Yong (yong.zhang@helmsmanlaw.com)

[1] See s 5B CLA.

[2] There is no statutory limit on any uplift fee, unlike what is seen in other jurisdictions like England & Wales (up to 100% of normal professional fees, excluding disbursements) or New South Wales, Australia (up to 25% of normal professional fees).

This publication is provided for general information purposes only and does not constitute legal or professional advice. It does not purport to be comprehensive or address every aspect of the matters discussed. While we strive to ensure the accuracy of the information at the time of publication, we make no representations or warranties as to its accuracy, completeness, or suitability for any particular purpose. You should seek specific legal or professional advice before taking any action based on the contents of this publication. We do not accept any liability for any loss or damage arising from any reliance placed on this publication or its contents. No lawyer-client relationship is created by this publication.

We stand ready to help you capture the opportunities and navigate unchartered territory. To find out more, please feel free to contact us: